As long as they provide all of the necessary information, colleges can choose from a variety of ways to satisfy the Net Price Calculator requirement. In your investigation of college costs, you may find yourself using NPCs that seem very different from each other. The sections below will help you understand these different types and how to get most useful results from each one. Full disclosure: this article is created by a company which designs and develops NPCs, so of course we have strong opinions about what an NPC "should" be like, and those opinions are reflected in this article.

The Federal Template and how to use it

The U.S. Department of Education offers its own version of Net Price Calculator software, known as the federal template, which is used by many colleges. The template usually looks basically the same on any college's website, so you can recognize it quickly. It looks like this:

The template has the advantage of being very quick and easy to use. However, the small number of questions and the type of data used also bring disadvantages.

Previous Year Data: The first important thing to notice about a federal template NPC is which year the data is based on (a disclaimer in the results will tell you). Because of the way the template estimates EFC, each academic year's template can't be made available to colleges until several months after the year is over. Since colleges are required to base everything in the NPC on the same year, costs and financial aid estimations provided by the NPC will also always be for a previous year. If you are using NPCs the year before you plan to enroll, a federal template NPC will generally give you results (including tuition and fees) from at least two years before your first year in college.

Dependency Status: As a student applying for financial aid, you may be considered either "dependent" or "independent". You don't get to choose this status yourself, it is determined by several questions that you answer when you fill out the Free Application for Federal Student Aid (FAFSA). Dependent students have to submit their parents' financial information for consideration, whether or not they will be providing financial support. Independent students have only their own (and their spouse's, if applicable) income and assets considered when applying for financial aid. In general, you are considered dependent if you will be under age 24, are not married, and do not have children you support. The federal template contains these three questions. There are several additional ways that you could appear to be dependent based on those questions, but actually be independent. For example, veterans and students serving on active military duty are automatically independent. You can see the rest of the ways on this Department of Education website. To maximize accuracy of the calculation, we recommend that you enter an age of 24 when completing the template, if you would be considered independent based only on one of the additional criteria that are not asked in the template.

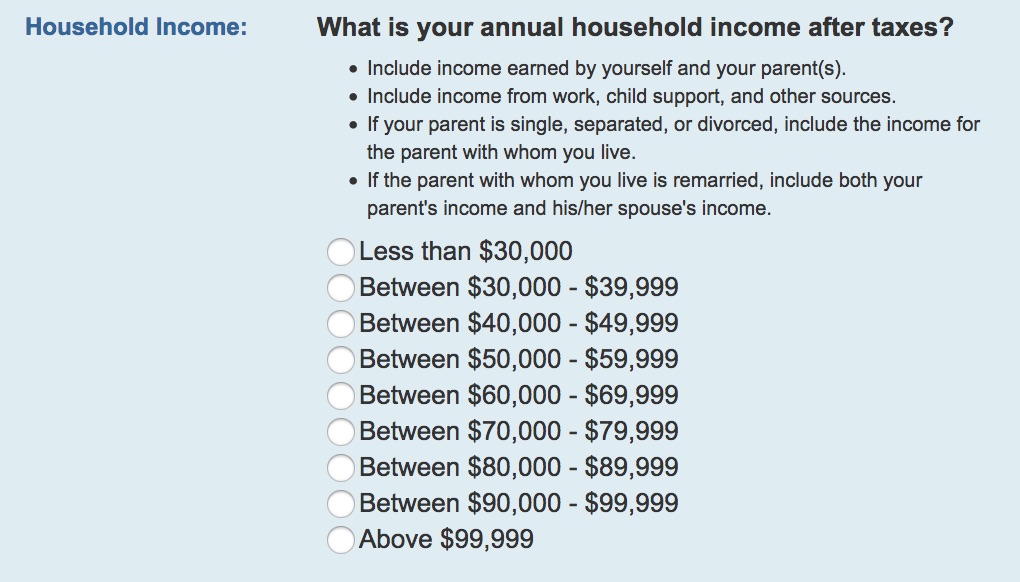

EFC Estimation: When you are applying for financial aid, one of the most important factors your college will consider is a single number known as the Expected Family Contribution (EFC), as calculated by the FAFSA. You can use our EFC Calculator to learn more about yours. The FAFSA has roughly 60-100 questions, depending on your dependency status, most of which are used in calculating the EFC. The template asks 7-9 questions. The only financial question is household income, which is divided into the following ranges:

Using data from FAFSA files in the given year, the questions are used to sort users into one of 12 EFC ranges. You won't see which EFC range was used in your estimation. Here are some things you can do to make sure this estimation is as accurate as possible, and some things to know about the results:

- When you are estimating income, don't just use the AGI on your tax return. You should also include any untaxed income you (or your parents or spouse if applicable) receive— things like contributions to retirement accounts, disability benefits, veterans' non-education benefits, and child support received.

- You might notice there is no question on the template about your assets (money you have saved, investments, property). The EFC calculation is more driven by income and less by assets than you might think, and the value of your home is not included in the federal calculation at all (investment property is included). Since the template's EFC is calculated using median data from actual FAFSA filers, some amount of assets is assumed. If you think you have higher assets than would be expected based on your annual income, you should know that the template may underestimate your EFC.

- If you are a dependent student and your parents are divorced or separated, make sure to include the correct parent's information (this is important for any NPC). When you apply for financial aid, you will be asked to include information about your "custodial parent". This is the parent you live with the most. If you don't live with your parents, use the last year that you did to determine custodial parent. If your custodial parent is married to someone else, you will need to include your stepparent's information, too, even if they are not contributing to your education.

Grant and Scholarship Estimation: The federal template results include one line item labeled, "Estimated total grant aid". The results that you see here include "both merit and need based grant and scholarship aid from Federal, State, or Local Governments, or the Institution". When setting up their templates, colleges calculate these amounts using data from the year on which the NPC is based. They add up the included types of aid for each student, and determine the median total aid for each of the 12 EFC ranges. The number you see is the median amount of aid for students in the EFC range the NPC has estimated for you. As you can imagine, the range of actual awards can be quite large, and depend on a wide variety of factors not asked about in the federal template. Most notably the template does not include any questions about academic merit, which is a large part of many colleges' aid awards. Athletic scholarships and awards based on artistic/musical talent are also included in the data used to calculate median grant aid. Unless the template is for a college with in-state vs. out-of-state cost difference, the template also doesn't ask you anything about your state of residence. Aid from your state can also be a large factor in your award.

Non-Citizens: The first question in the federal template is, "Do you plan to apply for financial aid?" If you are not a U.S. Citizen, and not eligible for federal student aid, you should answer "no" to this question, and you will not be asked further questions to determine EFC. The Grant and Scholarship results you see will be the median amount for students who did not complete the FAFSA. The amount you see may not be $0, since it may include merit-based and other awards that do not require a FAFSA. U.S. Citizens who did not apply for financial aid are also included in the group used to calculate this median, so it is a good idea to research whether non-citizens are eligible for merit-based or any other types of aid at your college of interest. You can often find this information on the college's website.

Not Included: The federal template results do not include information about any of the types of financial aid that are not part of net price. You will not see loans, work-study or veteran/military benefit amounts in the results. In a federal template NPC, the results you see will only be relevant to first-time, full-time undergraduate students. If you plan to enroll as a transfer, part-time or graduate students, these results will not apply to your situation.

Custom NPCs and how to use them

Instead of using the federal template, colleges also have the option of building their own NPC or paying a third party to provide a custom NPC. A custom NPC can mean anything from the federal template with a few extra bells and whistles added, to something much more thorough and robust. This section should give you an idea of the range of customization you may see, and how to make the most of different types of custom NPCs. If you have not read the previous section about the Federal Template NPC, please scroll up and do so before reading this one.

Which Year's Data? Custom NPCs often do not rely on historical data, meaning they can be updated to use the current or upcoming year's costs and aid eligibility. Pay special attention to which year the results are based on.

EFC Estimation: Unless it includes only the exact same questions as the federal template, a custom NPC is likely to be using the actual federal EFC calculation, making it much more accurate than the template. The more financial questions are included in the NPC, the more likely the EFC calculation will match closely or exactly what will be calculated when you complete the FAFSA— that is, as long as you take the time to complete it accurately.

EFC Bypass: Some custom NPCs offer the option to enter an EFC and skip the financial questions entirely. This can be a great time-saver. You can calculate an accurate EFC using our EFC Calculator. If you are putting in the effort to calculate an EFC that you will be used in multiple NPCs, make sure that you do it right. Sit down with your actual tax returns and financial records, rather than estimating with round numbers.

Grant and Scholarship Estimation: The types of aid included in the grant and scholarship calculation are the same custom NPCs as for the template. However, most of the custom NPCs have a much more complicated calculation that allows them to more accurately determine your individual eligibility for each type of award. Instead of relying on median data, custom NPCs can be designed to use the actual formula that colleges use when calculating your aid eligibility. Paying attention to the questions asked will tell you what the NPC is considering when determining your award. Most custom NPCs do include academic merit consideration for colleges that offer merit-based aid. Since no NPC can calculate potential awards for athletic or artistic/musical talent, it is likely that custom NPC results will not include these at all. If these are a large factor in awarding at your college of interest (for example, if you are applying to an art or music school), you may see some additional information in the NPC results about the range of scholarship funds that could be available depending on talent-based factors.

Non-Citizens: Custom NPCs will often have a question about citizenship. It may be a simple yes/no or include multiple options. If it is a yes/no question, you should answer "yes" if you are not a U.S. Citizen, but are eligible for federal student aid. If you answer "no", the results you see will be specific to students not eligible for federal student aid. You will probably not be asked financial questions as a non-citizen. If you are, this likely indicates that the college has some of its own need-based aid available to non-citizens.

Contact Information: Many custom NPCs will ask for your contact information, so that the college can be in touch with you about financial aid. It is important to know that you do not have to provide it. Even if it is not obviously marked as optional, colleges are required to allow you to use the NPC anonymously, so you should be able to skip it and see the results. There are good reasons to provide the information if you are willing, since it can start a conversation between you and the college about your financial aid options.

Loans: Although student and parent loans are not subtracted from net price (appropriate, since you have to pay them back), they are part of the whole college affordability picture. Many custom NPCs will provide information about loans, or even calculate loan eligibility and show you an estimate of what your bill could look like with federal loans deducted.

Beyond First-Time, Full Time: Some custom NPCs provide information for populations not required to be served by the NPC. If you are not planning to enroll as a first-time full-time undergraduate student, remember that the NPC is not meant for you unless you are asked questions about that. If you will be a transfer student, look for a question about transfer credits or entering grade level. If you will be a part-time student, look for a question about number of credits or classes you plan to take each semester. Some colleges offer separate NPCs for first-time undergraduates and undergraduate transfer students. Sometimes net price calculation is available for graduate students. If you will be enrolling as a graduate student, look for an option to indicate that in the NPC. It is rare for need-based financial aid to be available for graduate students, so graduates will probably not be asked financial questions.

Learn about Comparing NPC results on the next page, return to article contents, or scroll down to read an important note about career colleges.